The Effect of Financial Leverage on Profitability Indicators in Iraqi Insurance Companies

DOI:

https://doi.org/10.51173/tjms.v2i1.12Keywords:

Insurance companies, Panel Data, ProfitabilityAbstract

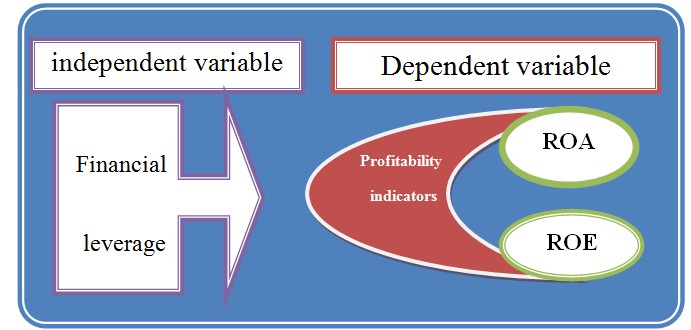

This study aims to measure the impact of the financial leverage ratio, an independent variable, on the profitability index, a dependent variable, for private insurance companies in the Iraqi insurance sector, including Dar Al-Salaam, Gulf, Al-Hamra, Al-Amen, and Al-Ahllia. Utilizing a descriptive analytical approach, the researcher employed measures of central tendency and conducted the analysis with the statistical program Eviews. The data, derived from annual financial reports published on the Iraq Stock Exchange from 2010 to 2021, was analyzed using linear regression models to test the study hypotheses. The findings indicate that financial leverage significantly influences both the rate of return on assets and the rate of return on equity. Based on these results, the study recommends that insurance companies focus on optimizing their financial leverage ratio to enhance revenue generation and profit accumulation, ultimately maximizing shareholder equity. Additionally, to improve their competitive position, companies should diversify their marketing strategies for insurance products and develop robust investment programs aimed at achieving higher returns, which would positively impact profitability.

References

Abdeljawad, L. M. Dwaikat, and G. Oweidat, “The determinants of profitability of insurance companies in Palestine,” An-Najah University Journal for Research-B (Humanities), vol. 36, no. 2, pp. 1–19, 2020.

A. Afolabi, J. Olabisi, S. O. Kajola, and T. O. Asaolu, “Does leverage affect the financial performance of Nigerian firms?,” Journal of Economics and Management, vol. 37, no. 3, pp. 5-22, 2019.

Z. Algamal, “Selecting Model in Fixed and Random Panel Data Models,” Iraqi Journal of Statistical Sciences, vol. 12, no. 1, pp. 266-285, 2012. doi: 10.33899/iqjoss.2012.60255.

M. A. Al-Hasanein, “Using cross-sectional time series models to measure the impact of information and communications technology on intra-regional trade of COMESA countries,” Journal of the Faculty of Economics and Political Science, vol. 24, no. 2, pp. 85-110, 2023.

A. Al-Mutairi, H. Naser, and K. Naser, “Determinants of corporate performance: Empirical evidence from the insurance companies listed on Abu Dhabi securities exchange (ADX),” Accounting, vol. 7, no. 1, pp. 143-150, 2021.

A. M. Badreldin, “Measuring the performance of Islamic banks by adapting conventional ratios,” German University in Cairo Working Paper, no. 16, 2009.

E. Beccalli, “Does IT investment improve bank performance? Evidence from Europe,” Journal of Banking & Finance, vol. 31, no. 7, pp. 2205-2230, 2007.

A. Burca, and M., & Batrinca, G. (2014). The determinants of financial performance in the Romanian insurance market. International journal of academic research in accounting, finance and management sciences, 4(1), 299-308.

X. Daniel, S. H. Lee, and T. Eom, “Introduction to panel data analysis,” Handbook of Research Methods in Public Administration, vol. 2, pp. 575-591, 2007.

M. Elsayed, “The Effect of Company Specific Factors on the Profitability of Property and Casualty Insurance industry in Egypt,” Journal of Financial and Business Research, vol. 21, no. 4, pp. 427-446, 2020.

R. A. Gilbert and D. C. Wheelock, “Measuring commercial bank profitability: Proceed with caution,” Networks Financial Institute Working Paper, no. 2007-WP-22, 2007.

H. S. Kazeem, “Firm specific characteristics and financial performance of listed insurance firms in Nigeria,” Unpublished M.Sc. Dissertation, 2015.

J. W. Murigu, “The determinants of financial performance in general insurance companies in Kenya,” Doctoral Dissertation, University of Nairobi, 2014.

J. Pearl and J. Rosenbaum, Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions, John Wiley & Sons, 2013.

[ 15] D. Lawrence. (2000), Managerial Finanace, 9th Edition, San Diego State University.

] M. Jensen, and W. Meckling. (2008). Theory of the firm: Managerial behavior, agency cost, & Capital structure. Journal of Financial Economics, (Vol. 3): pp: 305-360

M. A. Petersen and I. Schoeman, “Modeling of banking profit via return-on-assets and return-on-equity,” in Proceedings of the World Congress on Engineering, vol. 2, no. 1, pp. 12-37, July 2008.

V. Pierre, Finance D'entreprise, 8th ed., P. Quiry and Y. Le Fur, Eds., Editions Dalloz, Paris, 2010.

The published financial reports for insurance companies listed on the Iraq Stock Exchange for the period (2010-2020). [Online]. Available: http://www.isx-iq.net

V. A. Ansari,, & W. Fola, “Financial soundness and performance of life insurance companies in India”. International journal of research, 1(8), 224-254, 2014.