The impact of liquidity ratios on market value (MV) and market value added (MVA): “a case study of the Bank of Palestine"

DOI:

https://doi.org/10.51173/tjms.v2i1.14Keywords:

liquidity, liquidity ratios, market value, market value added, Bank of PalestineAbstract

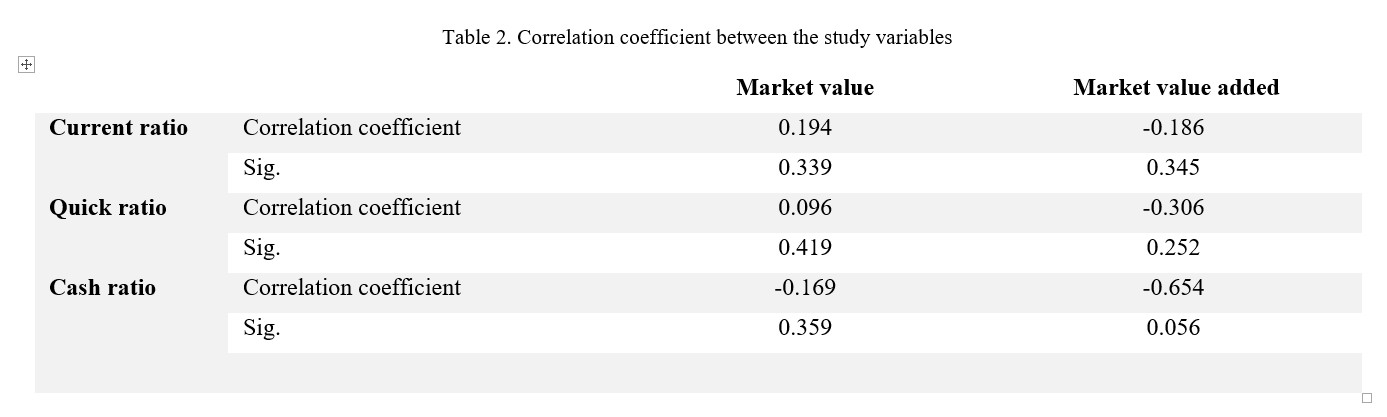

The study aimed to demonstrate the impact of liquidity ratios on the market value (MV) and market value added (MVA) of the Bank of Palestine traded on the Palestine Stock Exchange. The study was conducted over a period of time from 2017 to 2023. The researcher used the descriptive analytical method and the multiple regression model to analyze the data and test the hypotheses. The study reached the most important results that there is no statistically significant effect of liquidity ratios on market value. On the other hand, there was a statistically significant effect of liquidity ratios on the market value added of the Bank of Palestine.

References

J. Effendy and D. A. Surjandari, “The effect of market value added (MVA), liquidity and solvency ratio and dividend policy on stock return with firm size as the moderating variable (Study on LQ45 Companies in Indonesia Stock Exchange),” J. Econ., Finance Account. Stud., vol. 2, pp. 244–253, 2020. https://doi.org/10.32996/jefas.2022.4.1.16.

A. K. Al-Zahrani, “The Impact of Liquidity on the Market Value of Saudi Joint Stock Companies through 2011-2020,” J. Econ., Admin. Legal Sci., vol. 6, no. 15, pp. 40–60, May 2022. https://doi.org/10.26389/AJSRP.K100322.

A. Djani and A. Messatifa, “ The impact of liquidity risk on the market value of the shares of Saudi commercial banks, a standard study using cross-sectional data models panel for the period (2020-2022), Journal of excellence for economics and management research, vol.6, no.2, pp. 99-116, 2022.

S. Stu, “The effect of liquidity ratios and debt ratios on the market value of companies listed on the stock exchange - A study of a sample of companies listed on the Qatar Stock Exchange during the period (2009-2014),” M.S. thesis, Dept. Financial and Accounting Sciences, Kasdi Merbah Univ.-Warqla, Algeria, 2016.

R. Mriziq, “The effect of profitability ratios and liquidity ratios on the market value of the quoted institution - A study of a sample of institutions listed on the Qatar Stock Exchange during the period (2009-2012),” M.S. thesis, Dept. Financial and Accounting Sciences, Kasdi Merbah Univ.-Warqla, Algeria, 2014.

Ö. Korkmaz and M. Dilmach, “Financial factors affecting the market value of a company: Application to banking and insurance,” J. Manag. Econ. Res., vol. 16, no. 2, pp. 179–201, 2018.

S. Bogdan, S. Bareša, and S. Ivanović, “Measuring liquidity on stock market: Impact on liquidity ratio,” J. Tourism Hosp. Manag., vol. 18, no. 2, pp. 183–193, 2012.

V. W. Fang, T. H. Noe, and S. Tice, “Stock market liquidity and firm performance: Wall Street rule or Wall Street rules?” FMA Doctoral Student Seminar, Tulane Univ., New Orleans, LA, pp. 1–53, 2008.

W. G. Hardin, M. D. Hillii, G. W. Kelly, and J. O. Washamiv, “The market value of REIT liquidity,” Ph.D. dissertation, Florida Int. Univ. and Univ. Mississippi, 2009.

G. Aras, Ö. K. Furtuna, and F. M. Yildirim, “The impact of investment and financing decisions on market value in Turkey,” J. Bus. Res. Turk., vol. 9, no. 4, pp. 120–138, 2017.

M. Aql, Financial Management and Financial Analysis, 1st ed., Amman: Arab Society Library for Publishing and Distribution, 2011.

M. M. Olwan, “Using liquidity ratios and cash flow measures to predict profitability: An applied analytical study on the Palestinian Telecommunications Group,” M.S. thesis, Dept. Financial and Accounting Sciences, Kasdi Merbah Univ.-Gaza, Palestine, 2015.

Taneeb and Ebaidat, Financial Management in the Private Sector, 1st ed., Amman: Dar Al-Bedaya for Publishing and Distribution, 2009.

M. K. Ercan and U. Ban, Financial Management, 10th ed., Ankara: Kitabevi, 2018.

Investopedia. (2024, March 16). What Is Market Value, and Why Does It Matter to Investors? By James Chen [Online]. Available: https://www.investopedia.com/ask/answers/06/economicvsmarketvalueadded.asp.

Investopedia. (2022, July 30). Economic Value Added vs. Market Value Added: What’s the Difference? By Chris Gallant [Online]. Available: https://www.investopedia.com/ask/answers/06/economicvsmarketvalueadded.asp