The Relationship between Financial Flexibility and Banking Efficiency: Application Study at Iraqi Private Banks

DOI:

https://doi.org/10.51173/tjms.v1i1.7Keywords:

Banking Efficiency, Bankruptcy Prediction, Capital Structure, Sustainable Finance, Economic CrisesAbstract

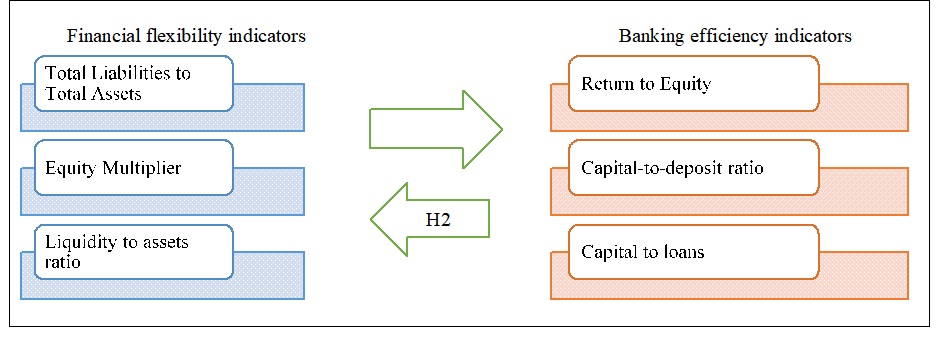

This study aims to investigate the effect of financial flexibility on rising banking efficiency in private Iraqi banks listed by the Iraqi Securities Commission (ISC). Financial flexibility refers to the bank's ability to grow and remain in the financial markets during sudden economic crises. Whereas banking efficiency demonstrates the bank's ability to use its available resources to achieve profits while providing high-quality banking services. In total, five Private Iraqi Banks listed within the ISC were selected that achieve the research objectives. The study problem reveals whether the selected banks have greater financial flexibility that contributes to improving overall their performance. The official annual reports published were approved by ISC for the period 2011-2020. Accordingly, quantitative statistical analysis methods were used in addition to financial analysis standards in order to prove the extent of the impact of financial flexibility variables in increasing the banking efficiency of the selected banks. The most important indicators measure the ratios of total liabilities, total assets, equity, liquidity ratio, return ratio, capital ratio, deposits, and loan ratio. The important conclusion indicated that the liabilities-to-assets ratio indicator reflects a close and stable level for the selected banks within the study period. This proves that the selected banks have financial flexibility in deploying funds. Accordingly, this study contributes by providing valuable insights to both financial institutions and policy-makers to promote a more flexible and efficient banking sector.

References

Bukair, Abdullah Awadh Abdullah, "Factors influencing Islamic banks’ capital structure in developing economies," Journal of Islamic Accounting and Business Research, vol. 10, no. 1, 2019, pp. 2-20. https://doi.org/10.1108/JIABR-02-2014-0008.

Mahmood, Y., Rashid, A. and Rizwan, M.F., "Do corporate financial flexibility, financial sector development and regulatory environment affect corporate investment decisions?”, Journal of Economic and Administrative Sciences, vol. 38, no. 3, 2022, pp. 485-508. https://doi.org/10.1108/JEAS-10-2019-0109.

Kantharia, N.J. and Biradar, J., "What influence the performance of banks? Evidence from public sector banks in India", Journal of Indian Business Research, vol. 15, no. 1, 2023, pp. 23-39. https://doi.org/10.1108/JIBR-04-2022-0112.

Pagano, Marco, and Josef Zechner. "COVID-19 and corporate finance." The Review of Corporate Finance Studies, vol. 11, no. 4, 2022, pp. 849-879.

Dsouza, Suzan, Mustafa Raza Rabbani, Iqbal Thonse Hawaldar, and Ajay Kumar Jain. "Impact of Bank Efficiency on the Profitability of the Banks in India: An Empirical Analysis Using Panel Data Approach," International Journal of Financial Studies, vol. 10, no. 4, 2022, p. 93.

Islam, Rashidul, Ziaul Haque, and Rehnuma Hoque Moutushi. "Earnings quality and financial flexibility: A moderating role of corporate governance," Cogent Business & Management, vol. 9, no. 1, 2022, p. 2097620.

Pyka, Irena, and Aleksandra Nocoń. "Banks’ capital requirements in terms of implementation of the concept of sustainable finance." Sustainability, vol. 13, no. 6, 2021, p.3499, https://doi.org/10.3390/su13063499.

Abdulkareem, A. M., AlokKumar C., Ayat R. M., and Wafaa S. A., "Impact of effective working capital management and financial flexibility on the sustainable growth gap: an applied study of industrial companies in Iraq," International Journal of Accounting Research, vol. 8, no. 1, 2023, pp. 15-19. https://j.arabianjbmr.com/index.php/ijar/article/view/679.

Hilo, Sanaa, and Khelood Mkalaf, "Bankruptcy prediction: evidence-based experiences in the banks." In Proceedings of 2nd International Multi-Disciplinary Conference Theme: Integrated Sciences and Technologies, IMDC-IST 2021, 7-9 September 2021, Sakarya, Turkey. 2022. http://dx.doi.org/10.4108/eai.7-9-2021.2314783.

Mkalaf, Khelood A., and Sanaa Hasan Hilo. "Using the Tobin Q model to evaluate the impact of credit risks on the bank’s market value during the corona pandemic." Journal of Islamic Accounting and Business Research, vol. 14, no. 6, 2023, pp. 973-988. https://doi.org/10.1108/JIABR-08-2022-0201.

Mandegari, Ali, and Dariush Damoori, "The Effect of Financial Flexibility, Managerial Efficiency, and Life Cycle on the Financial Performance of Companies Listed in the Tehran Stock Exchange," Financial Management Strategy, vol. 11, no. 2, 2023, pp. 97-128.

Sang, Le Quang, "The value of financial flexibility, corporate investment policy and financial distress risk." PhD diss., University of Southampton, 2018. http://eprints.soton.ac.uk/id/eprint/427735

Ma, Chun-ai, Yanbo Jin, and Heng-Yu Chang. "Firm’s financial flexibility: Driving factors, flexibility degree and economic results: A comparison of America and China." International Journal of Economics and Finance, vol. 7, no. 11, 2015, pp. 52-61.

Wijana, I. Made, Anak Agung Putri, Suardani Suardani, I. Ketut Suwintana, and I. Gusti Putu Fajar Pranadi Sudhana. "Development of a Flexible Financial Planning Web-Based Application for Indigenous Communities at Village Credit Institution in Badung Regency, Bali." In International Conference on Applied Science and Technology on Social Science 2021, (iCAST-SS 2021), Atlantis Press, 2022, pp. 165-172, DOI:10.2991/assehr.k.220301.028.

Al-Slehat, Zaher Abdel Fattah. "The impact of the financial flexibility on the performance: An empirical study on a sample of Jordanian services sector firms in period (2010–2017)." International Journal of Business and Management, vol. 14, no. 6, 2019, pp.1-11, doi:10.5539/ijbm.v14n6p1.

Bisoyi, Padmalochana, Bhushan Pardeshi, Dipti Vashisth Sharma, and Pranita Burbure. "Factors Affecting Financial Flexibility of Central Public Sector Enterprises." In Flexibility, Innovation, and Sustainable Business, pp. 3-9. Singapore: Springer Nature Singapore, 2022, https://doi.org/10.1007/978-981-19-1697-7_1.

Fahlenbrach, Rüdiger, Kevin Rageth, and René M. Stulz. "How valuable is financial flexibility when revenue stops? Evidence from the COVID-19 crisis." The Review of Financial Studies, vol. 34, no. 11, 2021, pp. 5474-5521, https://doi.org/10.1093/rfs/hhaa134.

Quoc Trung, Nguyen Kim. "Determinants of bank performance in Vietnamese commercial banks: an application of the camels model." Cogent Business & Management, vol. 8, no. 1, 2021, p. 1979443. https://doi.org/10.1080/23311975.2021.1979443

Nguyen, Anh Huu, Hang Thu Nguyen, and Huong Thanh Pham. "Applying the CAMEL model to assess performance of commercial banks: empirical evidence from Vietnam." Banks and Bank Systems, vol. 15, no. 2, (2020, pp. 177-186.

Shah, Reeta Bharat, Arunima Haldar, and S. V. D. Nageswara Rao. "Economic value added: A financial flexibility tool." Corporate Ownership and Control (2014): 1727-9232. Available at SSRN: https://ssrn.com/abstract=2623562.

Teng, Xiaodong, Bao-Guang Chang, and Kun-Shan Wu, "The Role of financial flexibility on enterprise sustainable development during the COVID-19 crisis-A consideration of tangible assets," Sustainability, vol. 13, no. 3, 2021, pp. 1245. https://doi.org/10.3390/su13031245

Moyo, Vusani, and Demetris Markou. "The global financial crisis and the speed of capital structure adjustment: Evidence from South Africa." Journal of Economic and Financial Sciences, vol. 15, no. 1, 2022, p.754.

Degl'Innocenti, Marta, Kevin Grant, Aleksandar Šević, and Nickolaos G. Tzeremes. "Financial stability, competitiveness and banks' innovation capacity: Evidence from the Global Financial Crisis." International Review of Financial Analysis, vol. 59, 2018, pp. 35-46. https://doi.org/10.1016/j.irfa.2018.07.009.

James, Moshi. "Financial Flexibility and the Impact of the 2007/2008 Global Financial Crisis: Evidence from African Firms." Res. J. Financ. Account, vol. 7, 2016, pp. 85-92.

Rahimi, Kazem, and Alireza Mosavi, "Value of financial flexibility and firm’s financial policies: Empirical evidence from the firms listed in Tehran Stock Exchange," International Journal of Economics and Finance, vol. 8, no. 4, 2016, pp.207-215.

Al-Malkawi, Husam-Aldin Nizar, and Rekha Pillai. "Analyzing financial performance by integrating conventional governance mechanisms into the GCC Islamic banking framework." Managerial Finance, vol. 44, no. 5, 2018, pp. 604-623, https://doi.org/10.1108/MF-05-2017-0200.

Harkati, R., Alhabshi, S.M. and Kassim, S., "Does capital adequacy ratio influence risk-taking behaviour of conventional and Islamic banks differently? Empirical evidence from dual banking system of Malaysia", Journal of Islamic Accounting and Business Research, vol. 11 no. 9, 2020, pp. 1989-2015. https://doi.org/10.1108/JIABR-11-2019-0212.

Pervez, Asif, Nadia Mansour, and Rohit Bansal. "A Study on the Implementation of International Banking Standards by BCBS with Special Reference to Basel III Norms in Emerging Economies: Review of Empirical Literature." Artificial Intelligence and COVID Effect on Accounting, 2022, pp. 139-156, https://doi.org/10.1007/978-981-19-1036-4_10.

Phan, Hien Thu, Sajid Anwar, and W. Robert J. Alexander. "The determinants of banking efficiency in Hong Kong 2004-2014." Applied Economics Letters, vol. 25, no. 18, 2018, pp. 1323-1326, https://doi.org/10.1080/13504851.2017.1420870.

Hedija, Veronika, and Martina Kuncová. "Relationship between efficiency and profitability: The case of Czech swine sector," Spanish journal of agricultural research, vol. 19, no. 1, 2021, p. 102.

Shin, Dong Jin, and Brian HS Kim. "Bank consolidation and competitiveness: Empirical evidence from the Korean banking industry." Journal of Asian Economics, vol. 24, 2013, pp. 41-50. https://doi.org/10.1016/j.asieco.2012.07.004.

Thilakaweera, Bolanda Hewa, Charles Harvie, and Amir Arjomandi. "Bank outreach and performance: evidence from banking efficiency in Sri Lanka." (2016), pp.1-21, https://ro.uow.edu.au/buspapers/916/.

Gurrea-Martínez, Aurelio, and Nydia Remolina. "The dark side of implementing basel capital requirements: theory, evidence, and policy." Journal of International Economic Law, vol. 22, no. 1, 2019, pp.125-152, https://doi.org/10.1093/jiel/jgz002.

Wright, Sue, Elizabeth Sheedy, and Shane Magee. "International compliance with new Basel Accord principles for risk governance," Accounting & Finance, vol. 58, no. 1, 2018, pp. 279-311, https://doi.org/10.1111/acfi.12213.

Mili, Mehdi, Jean-Michel Sahut, Hatem Trimeche, and Frederic Teulon. "Determinants of the capital adequacy ratio of foreign banks’ subsidiaries: The role of interbank market and regulation," Research in international business and finance, vol. 42, (2017), pp. 442-453, https://doi.org/10.1016/j.ribaf.2016.02.002.

Mohammed, Abdul-hussein Jasim. "Measuring the determinants of capital adequacy and its impact on efficiency in the banking industry: a comparative analysis of Islamic and conventional banks." PhD diss., University of Bolton, 2018.

Fidrmuc, Jarko, and Ronja Lind. "Macroeconomic impact of Basel III: Evidence from a meta-analysis." Journal of Banking & Finance, vol. 112, 2020, p.105359. https://doi.org/10.1016/j.jbankfin.2018.05.017.

Gajurel, Dinesh. "Assessing the Cost Efficiency of Commercial Banks in Nepal: An Empirical Analysis." Journal of Comparative International Management, vol. 26, no. 1, 2023, pp. 65-97. https://doi.org/10.55482/jcim.2023.33536.

Wu, Huaqing, Jingyu Yang, Wensheng Wu, and Ya Chen. "Interest rate liberalization and bank efficiency: A DEA analysis of Chinese commercial banks." Central European Journal of Operations Research, vol. 31, no. 2, (2023), pp. 467-498. https://doi.org/10.1007/s10100-022-00817-1.

Daraio, Cinzia, and Leopold Simar. Advanced robust and nonparametric methods in efficiency analysis: Methodology and applications. Springer Science & Business Media, 2007.

Porcelli, Francesco. "Measurement of Technical Efficiency. A brief survey on parametric and non-parametric techniques." University of Warwick, vol. 11, no. 527, 2009, pp. 1-27.

Phuong, Le Thanh, Technical Efficiency of the Vietnamese Banking Sector: An Empirical Analysis Encompassing Pre- and Post-WTO Entry, Doctor of Philosophy thesis, School of Accounting, Economics and Finance, University of Wollongong, 2016. https://ro.uow.edu.au/theses/4809.

Le, Tu DQ. "Bank risk, capitalisation and technical efficiency in the Vietnamese banking system." Australasian Accounting, Business and Finance Journal, vol. 12, no. 3, 2018, pp. 41-61, doi:10.14453/aabfj.v12i3.4.

Tuan, Linh Trinh Doan. "Technical Efficiency of Vietnamese Commercial Banks." American Journal of Theoretical and Applied Business, vol. 6, no. 2, 2020, pp. 17-22, doi: 10.11648/j.ajtab.20200602.12.

Mahrani, Mayang, and Noorlailie Soewarno. "The effect of good corporate governance mechanism and corporate social responsibility on financial performance with earnings management as mediating variable." Asian Journal of Accounting Research, vol. 3, no. 1, 2018, pp. 41-60, https://doi.org/10.1108/AJAR-06-2018-0008.

Shahnia, Citra, and Endri Endri. "Dupont Analysis for the financial performance of trading, service & investment companies in Indonesia." International Journal of Innovative Science and Research Technology, vol. 5, no. 4, 2020, pp.193-211.

Jihad, Asaad Gheni, and Ahmed Muqdad Ismael. "" Predicting the Movement of Stock Prices Using Technical Analysis Indicators": Applied Research in a Sample of the Shares of Iraqi Private Commercial Banks." Journal of Techniques, vol. 5, no. 2, 2023, pp. 214-232, DOI: https://doi.org/10.51173/jt.v5i2.1144.

Riam Khalil Khudair, Ibtisam Ali Hussein, & Bader S. S. Hamdan. The Impact of Financial Control Technology in the Banking Business Environment: A Field Study in a Sample of Iraqi Banks. Journal of Techniques, vol. 5, no. (3), 2023, pp. 275–285. https://doi.org/10.51173/jt.v5i3.753

AlHakeem, Sama Hayder Abdulhussein, Nashaat Jasim Al-Anber, Hayfaa Abdulzahra Atee, and Mahmod Muhamad Amrir. "Iraqi Stock Market Prediction Using Artificial Neural Network and Long Short-Term Memory." Journal of Techniques, vol. 5, no. 1, 2023, pp. 156-163, DOI: https://doi.org/10.51173/jt.v5i1.846.